Determining roi on investment property

Here is a simple formula for determining the ROI of an office building you have purchased. In addition customers can lock in their rate.

How To Calculate Rental Income The Right Way Smartmove

A rental property can be a profitable real estate investment if you understand the risks involved as well as the potential return on investment ROI.

. If your rental income is 2000 a month that equals 24000 annually. ROI Gain from Investment Cost of Investment Cost of Investment. Divide the total annual return 19200 by the amount of the total investment 220000.

The discount is 05 percent of the principal amount up to 5000 which could help borrowers save money on their investment loan. Finally lets calculate your total return on investment after 10 years of ownership. The basic formula for ROI is.

Well in order to measure a return on investment we need to see how much profit an asset class has provided. Skip to content 1300 829 221. Rental property investment refers to the investment that involves real estate and its purchase followed by the holding leasing and selling of it.

To determine the Capital Works that James can claim as a property investment tax benefit in his most recent tax return please refer to the figure below. The ideal number here. ROI Gain from Investment - Cost of Investment Cost of Investment As a most basic example Bob wants to calculate the ROI on his sheep farming.

ROI Net Income Cost of Investment or ROI Investment Gain Investment Base The first version of the ROI formula net income divided by the cost of an investment is. With a monthly cashflow of 542 2000 rent - 1458 mortgage payment your annual cash return. In order to calculate the ROI we must divide the net gain by the.

350000 X 25. The Formula The fundamental formula of calculating the ROI is to. The final number to calculate is your ROI.

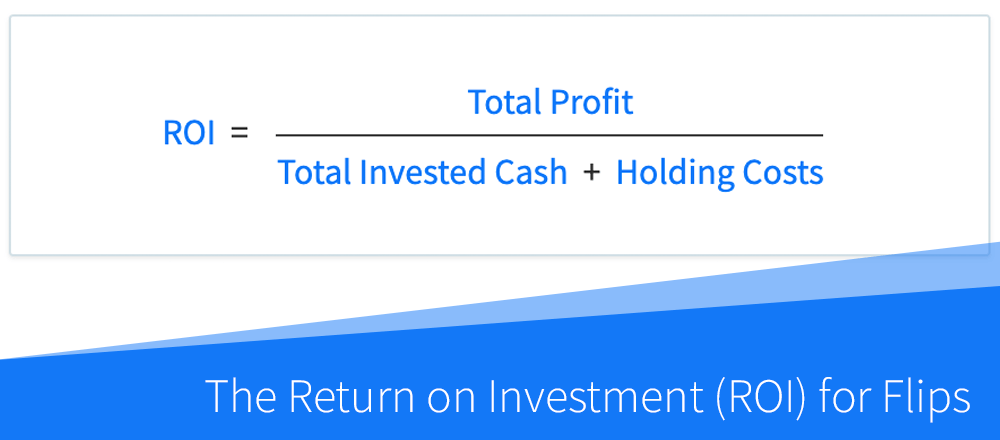

To do this you need to take the net income and divide it by the amount you will be paying for the property. Follow Property Returns guide to learn the importance of determining ROI on Investment Property when it comes to your portfolio. ROI Sale Proceeds Cumulative Cash Flow Total Invested Cash Total Invested Cash.

ROI 19200 220000 00872 X 100 872. The capital appreciation of the property after selling costs has increased by 3 equaling R30 900 R1 060 900 R1 030 000 To calculate the propertys ROI. To calculate the rental propertys ROI.

There are three basic methods of calculating ROI the formula the cost method or the out-of-pocket method.

How To Calculate Roi On Spanish Rental Property

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

How Do You Calculate Return On Investment On Rental Property

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Calculate Roi On Rental Property Rapid Property Connect

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

How To Calculate Roi On Rental Property Real Estate Skills

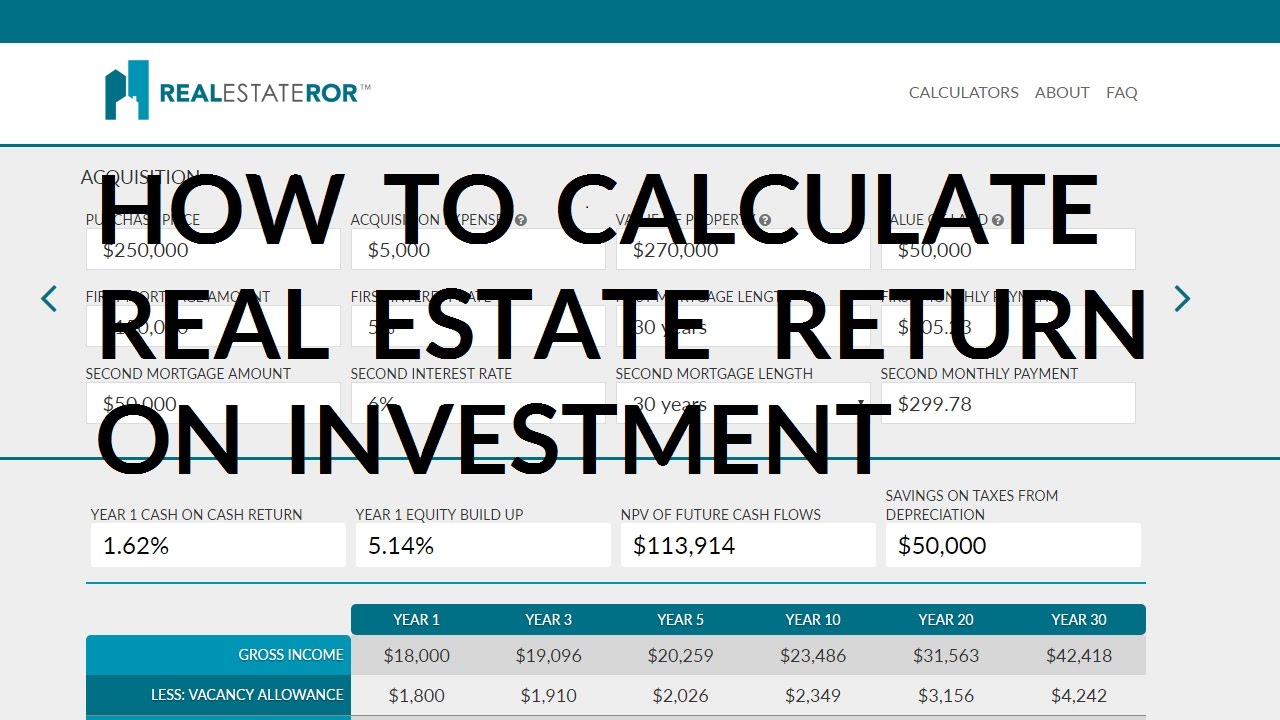

Rental Property Calculator Most Accurate Forecast

What Is A Good Return On Investment For Rental Properties Mashvisor

Roi In Real Estate How To Calculate Roi On Property 99acres

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

How To Calculate Roi On Residential Rental Property

Rental Property Roi And Cap Rate Calculator And Comparison Etsy

How To Calculate The Return On Investment Roi For Flips And Rehab Projects Dealcheck Blog

Rental Property Cash On Cash Return Calculator Invest Four More

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Calculate Roi On Rental Property Rapid Property Connect